A credit broker is a financial intermediary or middleman that connects borrowers with potential lenders, rather than lending money directly to borrowers. Here’s how credit brokers typically operate:

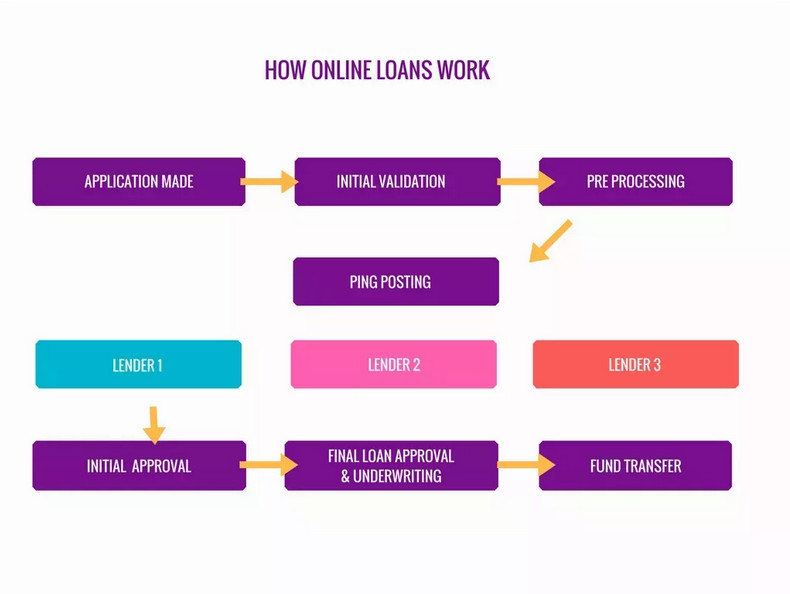

- Matching Borrowers and Lenders: Credit brokers serve as intermediaries between individuals or businesses seeking loans and financial institutions that provide loans. They maintain relationships with multiple lenders, such as banks, credit unions, or online lending platforms.

- Assessment and Information Gathering: Borrowers provide their financial information and loan requirements to the credit broker. This includes details about their credit history, income, desired loan amount, and the purpose of the loan.

- Searching for Lenders: The credit broker reviews the borrower’s information and assesses their creditworthiness. They then search their network of lenders to find potential matches that might be willing to offer a loan to the borrower.

- Loan Offers: Once suitable lender matches are found, the credit broker presents the borrower with a list of loan offers from various lenders. These offers may include details about interest rates, loan terms, and any associated fees.

- Comparison and Choice: The borrower can review and compare the loan offers provided by the credit broker. They can choose the offer that best suits their needs and financial situation.

- Application Submission: The chosen loan offer is then submitted to the respective lender for formal processing. At this point, the borrower’s application undergoes a more detailed review by the lender.

- Loan Origination: If the lender approves the application, they handle the loan origination process, including the disbursement of funds to the borrower.

- Commission or Fees: Credit brokers typically charge a fee or receive a commission from the lender for their services. This fee is usually paid by the lender, not the borrower. However, some brokers may charge borrowers for their services, so it’s important to understand the fee structure upfront.

It’s important to note that not all credit brokers are equal, and their reputation and legitimacy can vary. Some are reputable and work to connect borrowers with trustworthy lenders, while others may engage in unethical or fraudulent practices. As a borrower, it’s crucial to do your due diligence when working with a credit broker:

- Research the broker’s reputation and reviews.

- Understand their fee structure and how they make money.

- Be cautious about sharing sensitive personal and financial information.

- Read and fully comprehend the terms of any loan offers presented by the broker.

In some regions, regulations and laws may govern the operations of credit brokers to protect consumers. It’s advisable to check local regulations and verify the legitimacy of the credit broker you intend to work with to ensure a safe and transparent borrowing process.